ad valorem tax florida exemption

PDF 106 KB Individual and Family Exemptions Taxpayer Guides. The 2022 Florida Statutes.

Estimating Florida Property Taxes For Canadians Bluehome Property Management

TAXATION--Economic development ad valorem tax exemption.

. Florida Administrative Code. Authorized by Florida Statute 1961995 this incentive provides an exemption of up to 10 years from the property taxes both. The economic development ad valorem tax exemption program is designed to help existing businesses expand and encourage industries that offer higher-than-average.

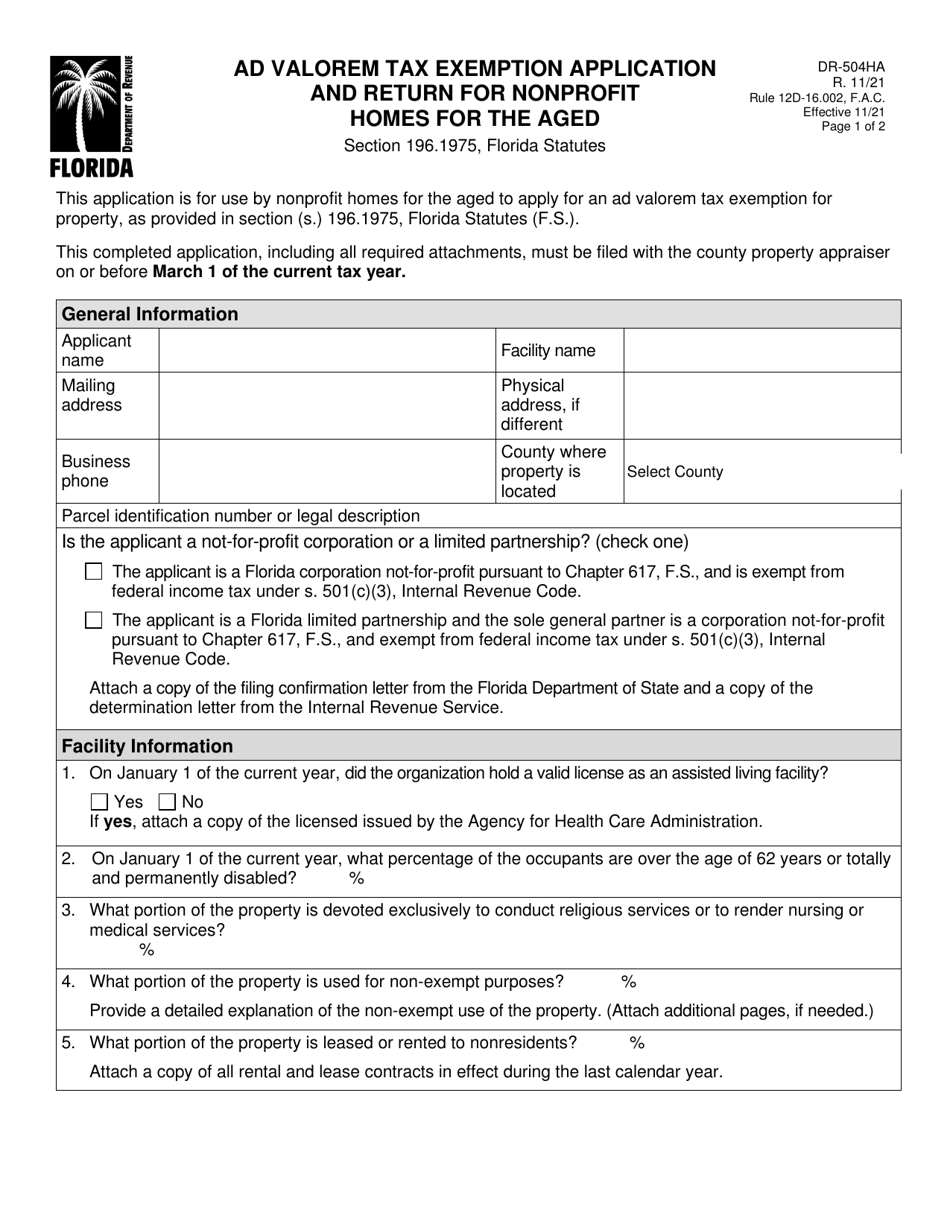

INDIVIDUAL AFFIDAVIT FOR AD VALOREM TAX EXEMPTION. Furthermore the court upheld the exemption because the discontinuance of the services provided by the Chamber of Commerce could result in the allocation of public funds. This application is for use by nonprofit homes for the aged to apply for an ad valorem tax exemption for property as provided in section s 1961975 Florida Statutes FS.

Florida property taxes vary by county. You may also be part of a special district or assessment boundary that has different taxes than a. This application is for use by nonprofit organizations to apply for an ad valorem tax exemption for property used predominantly for.

New residents to Georgia pay TAVT at a rate of 3 New. For example a 50 disability rating equals 500 off of a 1000 ad. Ad Download Or Email FL DR-418 More Fillable Forms Register and Subscribe Now.

Did you possess a valid license under Chapters 395 400 or part I of. The most common ad valorem taxes are property. PDF 125 KB Individual and Family Exemptions Taxpayer Guides.

Sections 196195 196196 and 196197 Florida Statutes. Authorized by Florida Statute. Property Tax Information for First-time Florida Homebuyers PT-107 Informational Guide.

The School Board of Hillsborough County wants to levy an additional tax of ad valorem operating millage of 1 mil annually one dollar of tax for each 1000 of assessment. What is ad valorem tax exemption Florida. Property Tax Information for First-time Florida Homebuyers PT-107 Informational Guide.

Ad valorem means based on value. A permanent resident of Florida that owns his or her principal residence in Florida qualifies for 1 a 50000 exemption and an additional 50000 exemption if the owner is age 65 or older. An ad valorem tax is based on the assessed value of an item such as real estate or personal property.

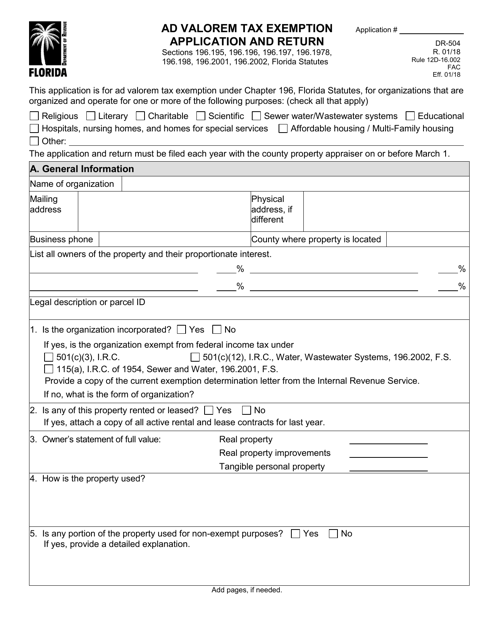

The applicant must submit both. This benefit is a discount on the property tax bill not an exemption based on the propertys assessed value. This application is for ad valorem tax exemption under Chapter 196 Florida Statutes for organizations that are.

What is ad valorem tax exemption Florida. HOMES FOR THE AGED. A sales tax is type of ad valorem tax on goods or services.

Ad Valorem Tax Exemption. Ad Valorem Tax Exemption Application and Return for Nonprofit Homes for the Aged Form DR-504HA incorporated by reference in Rule 12D-16002 FAC. Non-titled vehicles and trailers are exempt from TAVT but are subject to annual ad valorem tax.

Property subject to taxation. Authorized by Florida Statute 1961995 this incentive provides an exemption of up to 10 years from the property taxes both. An ad valorem tax is typically imposed when property is purchased in the form of value added tax or a sales tax.

Ad valorem tax exemptions are available in Florida for projects i wholly owned by a nonprofit entity that is a corporation not-for-profit or its wholly owned subsidiary qualified. The greater the value the higher the assessment. One valuable tax break which is available in a number of Florida counties and cities is the Economic Development Ad Valorem Tax Exemption.

Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. This is in response to your request for an Attorney Generals. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

This local program is authorized by Section 1961997 Florida Statutes and allows counties and municipalities to adopt ordinances. Title XIV TAXATION AND FINANCE. In Florida property taxes and real estate taxes are also known as ad valorem taxes.

Section 1961975 Florida Statutes. Some counties use only or nearly only valorem taxes. Ad Valorem Tax.

Property Tax Exemption for Historic Properties.

Florida Homestead Exemption Martindale Com

Protect Your Property From Creditors And Reduce Your Property Taxes Using Florida S Homestead Exemption

Fill Free Fillable Forms For The State Of Florida

How To File For Florida Homestead Exemption Tampa Bay Title

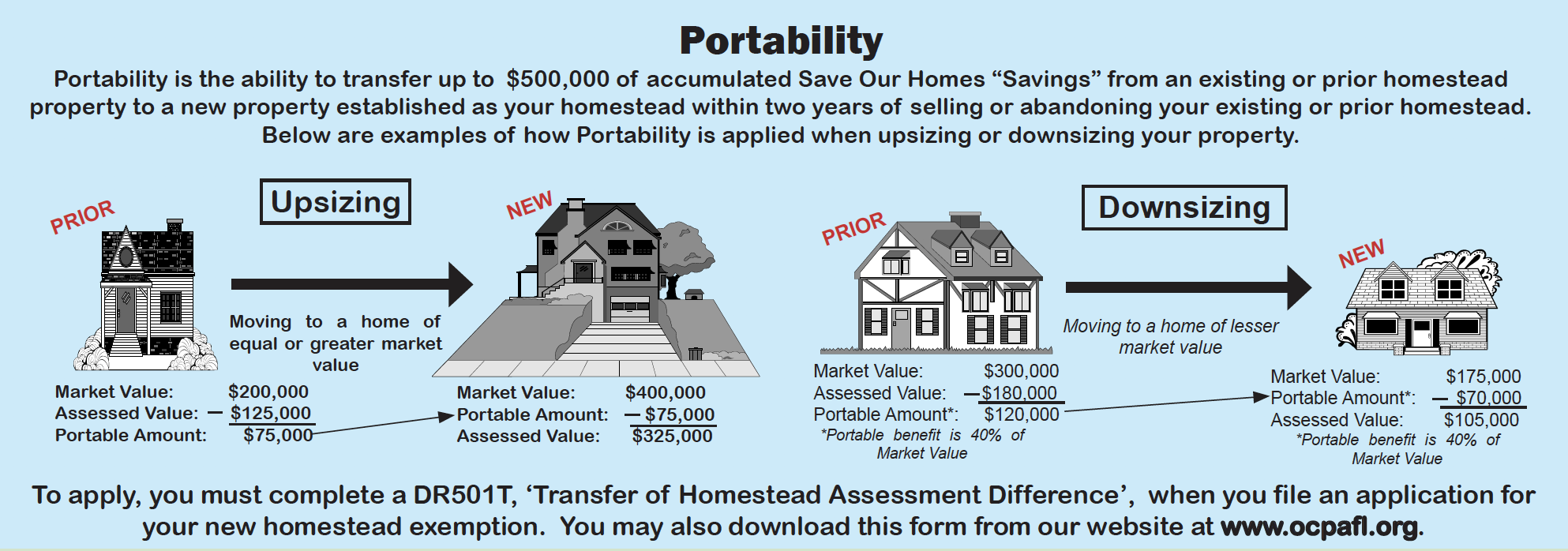

Tax Portability Transfering Your Tax Benefits From Your Old Homestead To Your New One

What Is A Homestead Exemption And How Does It Work Lendingtree

Homestead Portability Transferring Your Florida Homestead Cap To Your New Home Infinity Realty Group

Florida Homestead Exemption How It Works Kin Insurance

Form Dr 504ha Download Fillable Pdf Or Fill Online Ad Valorem Tax Exemption Application And Return For Nonprofit Homes For The Aged Florida Templateroller

Must Know Facts About Florida Homestead Exemptions Lakeland Real Estate

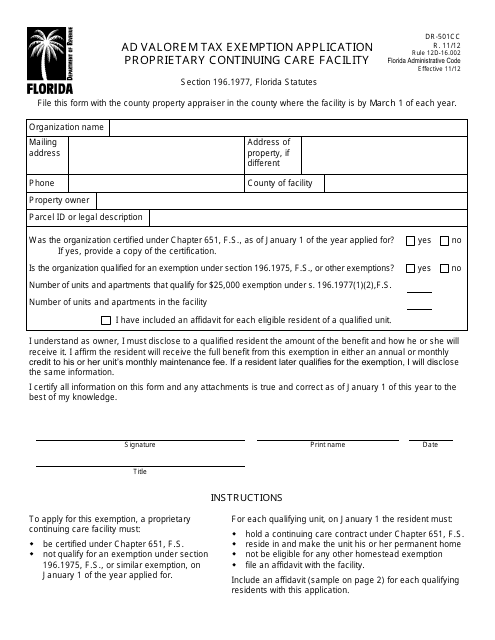

Form Dr 501cc Download Printable Pdf Or Fill Online Ad Valorem Tax Exemption Application Proprietary Continuing Care Facility Florida Templateroller

Form Dr 504cs Download Fillable Pdf Or Fill Online Ad Valorem Tax Exemption Application And Return For Charter School Facilities Florida Templateroller

Form Dr 504 Download Fillable Pdf Or Fill Online Ad Valorem Tax Exemption Application And Return Florida Templateroller

Estimating Florida Property Taxes For Canadians Bluehome Property Management